HCCs (Hierarchical Condition Categories) aren’t a new idea, but they didn’t attract wide interest until CMS began shifting more payment toward value-based programs, particularly MACRA, which affects clinician reimbursement. Organizations are rapidly shifting towards it.

HCCs Explained:

So there has been renewed interest in the concept. And it makes sense – without solid basic knowledge of HCCs, health systems may be at risk of lower rates of reimbursement, or not getting paid at all.

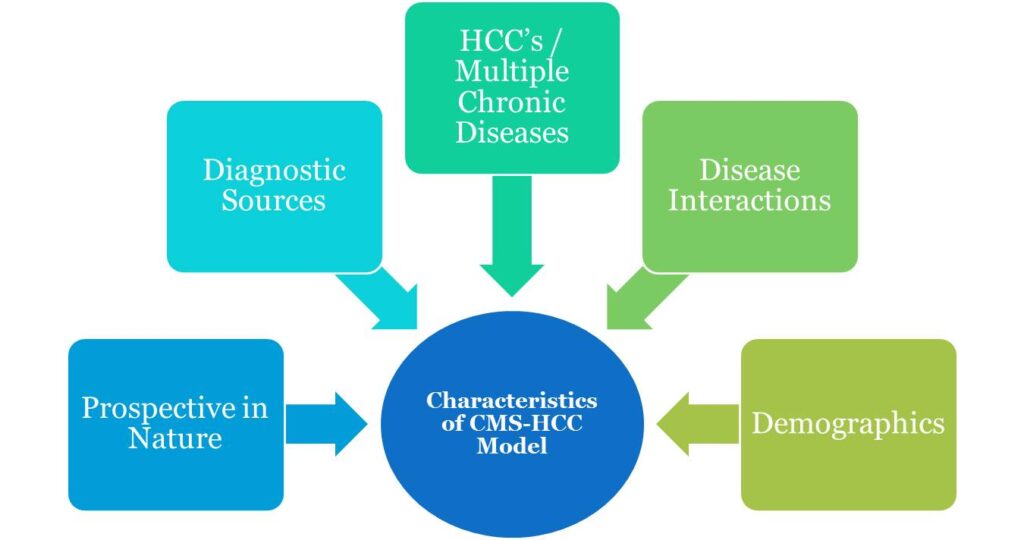

Since 2004, HCCs have been used by the CMS (Centers for Medicare and Medicaid Services) as a part of risk-adjustment model to identify its beneficiaries with chronic and acute conditions. HCCs are sets of medical codes that are linked to specific diagnoses.

Medicare uses this to project the expected risk and future annual cost of care. Each HCC code set represents diagnoses with similar clinical complexity and expected annual care costs.

Who Use HCCs and How?

Clinicians update HCCs to a patient’s medical records and add supporting documentation as required by CMS.HCCs are used to calculate reimbursements to healthcare organizations for beneficiaries who are insured by Medicare Advantage (MA) plans, Accountable Care Organizations (ACOs), A few Affordable Care Act (ACA) plans and many more.

Kinds of HCCs represented conditions?

As of 2022, there are 86 HCC codes, arranged into 19 categories. These 86 codes are comprised of 9,700 ICD-10-CM codes, each representing a single medical condition. HCC codes include costly chronic health conditions and some severe acute conditions. The top HCC categories include;

- Major depressive disorders

- Major bipolar disorders

- Asthma

- Pulmonary disease

- Diabetes,

- Specified Heart Arrhythmias

- Congestive Heart Failure

- Breast Cancer

- Prostate cancer

- Rheumatoid arthritis

RAF Value and Its use in HCCs:

A Risk Adjustment Factor, known as a RAF Value or RAF score, is a measure of the estimated cost of an individual’s care based on their demographic information and disease severity, each calendar year. The RAF value is then used to calculate reimbursements to healthcare organizations. Each HCC associated with a patient is assigned a relative factor that is averaged with any other HCC code factors and a demographic score.

The resulting score is then multiplied by a predetermined dollar amount to set the PMPM (per-member-per-month) capitated reimbursement for the next period of coverage. The PMPM is the payment amount a provider receives for a patient enrolled in an MA plan regardless of services provided. The more a patient is healthier the lower is the average RAF value. While the more a patient is sicker the higher is the RAF value. Which impacts the calculated reimbursement amount. Scores are calculated on an annual basis.

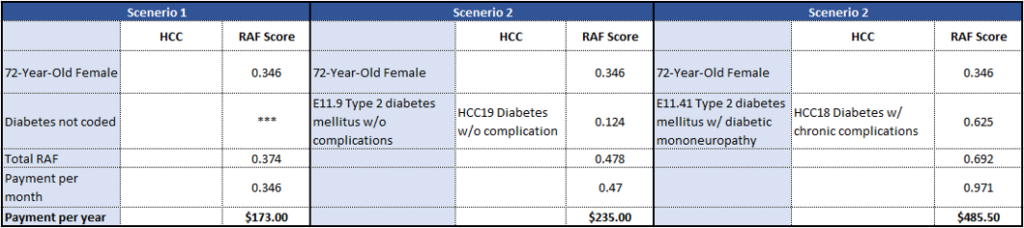

Example 1:

If the capitated rate the plan receives per member per month (PMPM) from CMS is $500. That depicts the starting point and that rate is adjustable based on the HCC scores. If the patient has diabetes w/ complications but that is not coded or not fully coded, the payment impact is obvious:

Example 2:

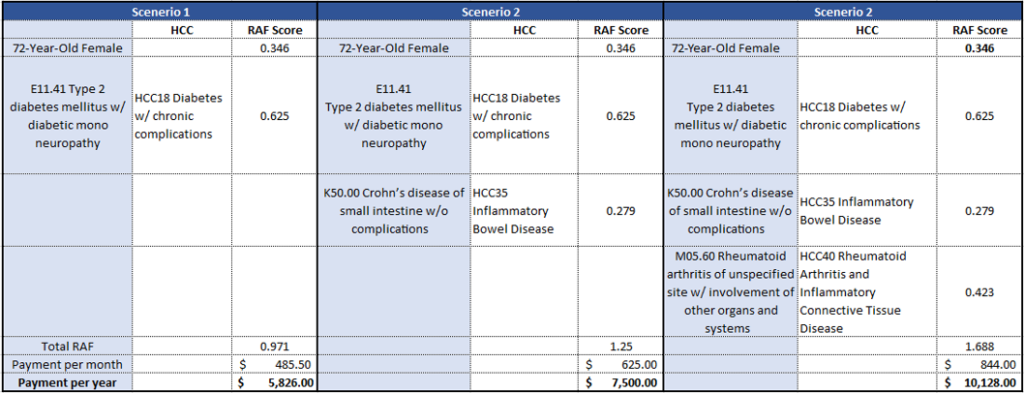

If the same patient has multiple conditions that impact toward the HCC score or adjustment. Missing documentation may carry a cost:

HCCs impact on reimbursement:

HCCs have direct impact on the amount of money received by healthcare organizations from the largest single payer in healthcare, CMS. Patients with high HCCs require intensive medical treatment, and clinicians that enroll these high-risk patients get reimbursements at higher rates than those with enrollees who have low HCCs.

Organizations or clinicians who do not document HCC codes properly or to the highest specificity will not receive these additional reimbursement amount for applicable patients.

Specificity is mandatory to receive full payment. For example, diabetes without chronic complications, HCC code -19, pays a $894.40 premium bonus, while diabetes with ESRD, requires two HCC codes, code no. 18 and code no. 136, and has a bonus of $1273.60. The ability to document with greater precision can drastically effect payment amounts.