Denial Management Process: Introduction

Effective denial management is vital for healthcare providers to maintain financial stability and ensure that services rendered to patients are appropriately reimbursed. Denials can occur due to various reasons, such as coding errors, missing documentation, inaccurate patient information, and failure to meet payer-specific guidelines. By establishing a structured denial management process, healthcare organizations can identify and rectify these issues promptly, leading to improved cash flow and reduced revenue leakage.

In the complex world of medical billing, denial management plays a critical role in ensuring that healthcare providers receive rightful reimbursement for their services. It is a process that involves tracking and addressing claim denials promptly and efficiently, allowing medical facilities to optimize revenue cycles and maintain financial stability. In this article, we will explore the denial management process in medical billing and the way denials are being handled, even for beginners in the field.

Understanding Denial Management in Medical Billing

Step 1: What is Denial Management?

Denial management is the process of identifying, appealing, and rectifying claim denials to receive the appropriate reimbursement from insurance payers. Denials can occur for various reasons, such as coding errors, missing information, eligibility issues, or non-covered services. It is crucial for healthcare facilities to have a robust denial management process in place to minimize revenue loss and maintain a healthy cash flow.

Step 2: Why is Denial Management Essential?

Effective denial management is vital for healthcare providers for several reasons. Firstly, it helps prevent revenue leakage and ensures that claims are paid correctly and on time. Secondly, it enhances the overall operational efficiency of medical billing by reducing the number of denied claims and rework involved. Lastly, denial management ensures compliance with insurance regulations, reducing the risk of legal issues or audits.

Step 3: The Key Steps of Denial Management

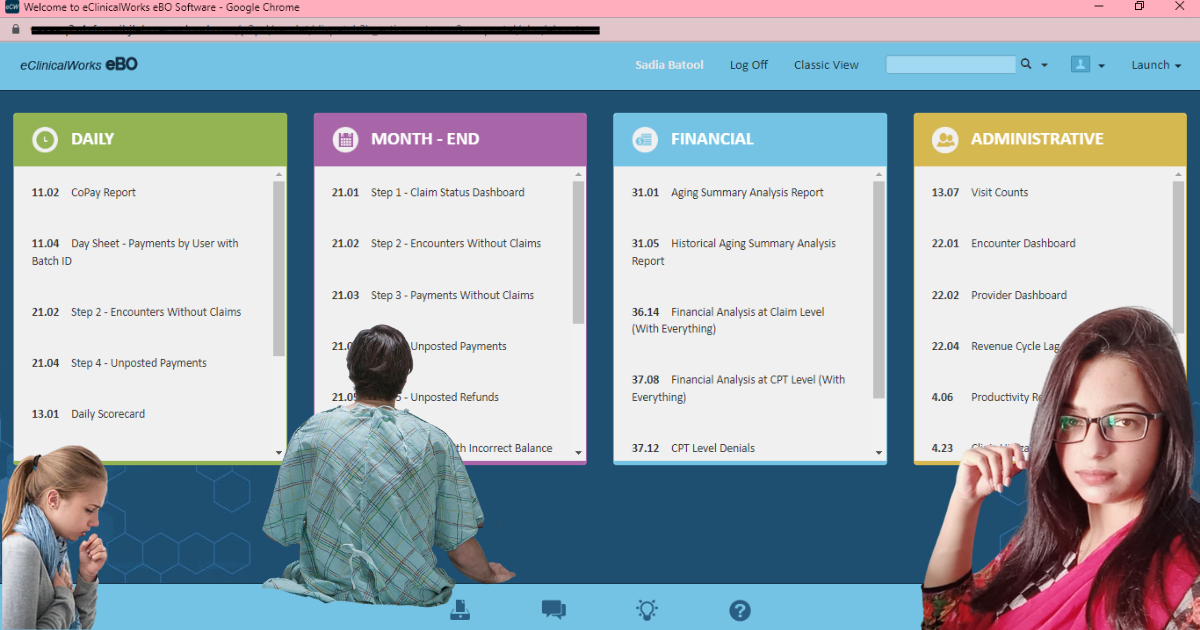

Denial Identification: The first step in the denial management process involves identifying and tracking denied claims. This can be done through robust billing software or revenue cycle management systems that flag denied claims for further investigation.

Analyzing Denial Patterns or Root Cause Analysis: Once denials are identified, it’s essential to analyze patterns to uncover the root causes. Identification of trends and common errors, helping healthcare providers understand recurring issues and take corrective action.

Denial Categorization: Denials are categorized based on their underlying reasons, such as coding errors, eligibility issues, pre-authorization problems, or timely filing denials. Proper categorization aids in prioritizing the most significant denial issues and designing appropriate solutions.

Corrective Action: Based on the analysis, the denial management team can implement corrective measures. This may involve updating coding practices, enhancing documentation, or clarifying eligibility criteria with insurance payers.

Appeal Process: Once the root cause is identified, healthcare providers can initiate the appeal process for denied claims. This involves gathering relevant documentation, crafting persuasive appeals, and adhering to specific payer guidelines and deadlines.

Training and Education: A proactive approach to denial management includes regular training and education for billing and coding staff. Keeping them updated on industry changes, coding guidelines, and payer requirements can reduce errors and subsequent denials.

Workflow Optimization: Optimizing the billing workflow can significantly impact denial rates. Streamlining processes, enhancing communication between departments, and implementing technology-driven solutions contribute to a more efficient billing system.

Best Practices for Effective Denial Management

Real-Time Claim Tracking: Utilize advanced billing software that allows real-time tracking of claims. This ensures timely identification and follow-up on denied claims, reducing delays in the appeals process.

Robust Documentation: Accurate and comprehensive documentation is crucial to support claim appeals. Ensure that all medical records, coding details, and authorization documentation are organized and easily accessible.

Establish Key Performance Indicators (KPIs): Define and monitor KPIs related to denial rates, appeal success rates, and resolution turnaround time. KPI tracking provides valuable insights into the effectiveness of the denial management process.

Collaborative Approach: Foster collaboration between billing, coding, and clinical staff to address denial root causes effectively. Regular meetings and open communication channels can facilitate problem-solving and process improvement.

Monitor Payer Trends: Stay informed about payer policies, trends, and updates to adapt billing practices accordingly. Payer-specific knowledge can help minimize denials related to specific requirements.

Denial Management is as necessary as the success

An effective denial management process is integral to successful medical billing practices. By identifying, analyzing, and resolving claim denials efficiently, healthcare providers can optimize revenue cycles, reduce financial losses, and enhance overall financial health. Emphasizing proactive strategies, such as staff education, streamlined workflows, and technology adoption, contributes to the long-term success of the denial management process and ensures that healthcare organizations can focus on providing quality patient care.

Practical Approach about denial Management:

You can better understand how you can resolve a denial of medical necessity not met. Here is a case study;

Case: Resolving a Medical Necessity Denial in Medical Billing

This case study explores how a healthcare provider, “ABC Medical Center,” effectively resolved a medical necessity denial in their medical billing process. The denial stemmed from the payer’s determination that a particular service provided to a patient was not medically necessary. The case study outlines the steps taken by ABC Medical Center to address the denial, leveraging a strategic approach to appeal the decision and secure proper reimbursement.

Hypothetical Background:

ABC Medical Center is a multi-specialty healthcare facility that offers a comprehensive range of medical services to its patients. One of their patients, Mr. John Smith, underwent a specialized diagnostic procedure to investigate chronic abdominal pain. Unfortunately, the payer, MNO Health Insurance, denied the claim, asserting that the procedure was not medically necessary based on their review.

Objective:

The primary objective of ABC Medical Center was to overturn the medical necessity denial and secure reimbursement for the provided service. The center aimed to demonstrate the appropriateness of the procedure based on Mr. Smith’s medical condition and ensure adherence to payer guidelines during the appeal process.

Challenges:

Lack of Comprehensive Documentation: The initial claim lacked sufficient documentation supporting the medical necessity of the procedure, leading to the denial.

Appeal Process Knowledge: ABC Medical Center’s billing team was relatively inexperienced in handling medical necessity denials and required guidance on the appeal process.

Approach:

Thorough Review and Consultation:

The billing team at ABC Medical Center began by reviewing the denial explanation from MNO Health Insurance. They consulted with the medical provider who performed the procedure, Dr. XYZ, to gain a comprehensive understanding of the case.

Document Verification and Gathering:

After consulting with Dr. XYZ, the billing team thoroughly reviewed Mr. Smith’s medical records and procedure notes. They gathered additional medical evidence, including imaging reports and previous test results, to support the medical necessity of the procedure.

Crafting the Appeal Letter:

The billing team collaborated with Dr. XYZ to draft a persuasive appeal letter. The appeal letter included a summary of Mr. Smith’s medical history, the details of the procedure, and an explanation of how it related to his chronic abdominal pain symptoms.

Submitting the Appeal:

ABC Medical Center followed MNO Health Insurance’s appeal guidelines and submitted the appeal letter along with the comprehensive documentation within the specified timeframe.

Timely Follow-Up:

The billing team consistently followed up with MNO Health Insurance to ensure that the appeal was received and actively being reviewed.

Professional Language and Tone:

The appeal letter and all communication with MNO Health Insurance maintained a professional and respectful tone, focusing solely on the medical evidence and patient’s health.

Results:

As a result of ABC Medical Center’s well-structured approach to the appeal process, the medical necessity denial was successfully overturned:

Claim Approval: MNO Health Insurance reconsidered the appeal and approved the claim, acknowledging the medical necessity of the diagnostic procedure.

Proper Reimbursement: ABC Medical Center received reimbursement for the procedure, ensuring financial stability for the provided services.

Conclusion:

This case study demonstrates the significance of a strategic approach to resolving medical necessity denials in medical billing. By conducting a thorough review of medical records, gathering comprehensive documentation, and crafting a persuasive appeal letter, ABC Medical Center effectively overturned the denial and secured reimbursement for the service provided to Mr. Smith. Healthcare providers can learn from this experience and apply similar methods to address future denials, ensuring adherence to payer guidelines and optimizing revenue cycles. Emphasizing the importance of collaboration between medical providers and billing teams is essential in successfully navigating the appeal process and maintaining financial stability in the ever-evolving healthcare landscape.