Understanding Medigap & Plans

As you approach retirement age, the complexities of Medicare can seem daunting. With Original Medicare’s gaps in coverage and the intricacies of Medicare Advantage plans, it’s easy to feel overwhelmed. This is where Medigap, also known as Medicare Supplement Insurance, comes in, offering a helping hand in navigating the Medicare landscape. Here we’ll learn about Medicap plans as well.

What is Medigap?

Medigap is supplemental insurance that helps fill the gaps in coverage of Original Medicare (Parts A and B). It’s sold by private insurance companies and is regulated by both federal and state governments. Medigap policies are standardized, meaning that they offer a specific set of benefits, regardless of which insurance company you choose. This standardization makes it easier to compare Medigap plans and find the one that best suits your needs.

Why Consider Medigap?

Original Medicare covers a significant portion of your healthcare expenses, but it leaves gaps in coverage that can result in out-of-pocket costs. These gaps include deductibles, coinsurance, and copays for various services, such as hospital stays, doctor visits, and prescription drugs. Medigap helps fill these gaps, providing you with more comprehensive coverage and potentially lower out-of-pocket expenses.

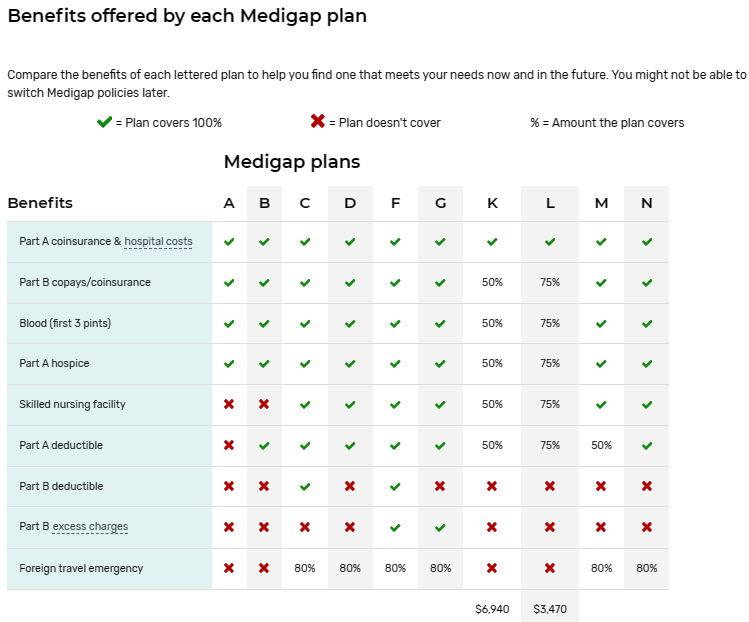

Types of Medigap Plans

There are 10 standardized Medigap plans, each designated by a letter, from Plan A to Plan N. Each plan offers a different level of coverage, with Plan A providing the most basic coverage and Plan N providing the most comprehensive coverage. The choice of plan depends on your individual needs and preferences.

Benefits of Medigap

Predictable Costs: Medigap premiums remain fixed, providing you with predictable monthly costs.

Widespread Acceptance: Medigap plans are accepted by healthcare providers nationwide, giving you flexibility in choosing your doctors and hospitals.

No Annual Cap: Unlike Medicare Advantage plans, Medigap plans don’t have an annual out-of-pocket maximum, so you’re protected from unexpected high costs.

Guaranteed Renewability: Medigap plans are guaranteed renewable, even if you develop health problems.

When to Enroll in Medigap

The best time to enroll in Medigap is during your Medigap Open Enrollment Period (OEP), which starts six months before you turn 65 and ends six months after your birthday. During this period, you can enroll in any Medigap plan without underwriting, meaning you can’t be denied coverage based on your health history.

Considerations Before Enrolling

Your Current Medicare Coverage: If you have a Medicare Advantage plan, you may not need Medigap. However, if you decide to switch back to Original Medicare, you’ll have a new OEP to enroll in Medigap.

Your Healthcare Needs and Budget: Consider your anticipated healthcare needs and your ability to afford the premiums. Choose a plan that provides the coverage you need while fitting within your budget.

Research and Compare Plans: Review the benefits and costs of different Medigap plans to find the one that best suits your needs. Consult with your insurance agent or a healthcare professional for personalized guidance.

Medigap: A Valuable Supplement to Medicare

Medigap plays a crucial role in bridging the gaps in Original Medicare coverage, providing you with more comprehensive protection against out-of-pocket expenses. By carefully considering your healthcare needs and researching available options, you can make an informed decision about whether Medigap is the right choice for you. Remember, the best time to enroll is during your Medigap Open Enrollment Period, ensuring guaranteed coverage without underwriting.

Medigap plans available by state

Medigap plans are standardized, meaning that they offer the same benefits regardless of which insurance company you choose. However, the availability of Medigap plans varies from state to state. In some states, all 10 Medigap plans are available, while in other states, only a few plans may be offered.

The following information shows the availability of Medigap plans in each state:

Medigap Plans in Michigan

When it comes to securing your healthcare needs, understanding the intricacies of Medigap plans is crucial. In Michigan, there are 12 Medigap plans available, each designed to fill the gaps in Original Medicare coverage. In this guide, we’ll explore the specifics of Medigap Plan A, shedding light on premiums, coverage details, and potential discounts.

Medigap Plan A Premiums

Medigap Plan A provides essential coverage for Medicare beneficiaries, and the premiums for a 65-year-old female non-tobacco user range from $74 to $211. It’s important to note that some insurance companies may offer household discounts on monthly premiums. To explore potential savings and eligibility information, it’s recommended to contact the insurance company directly.

Excluded Costs

While Medigap Plan A covers a wide range of services, there are certain costs it doesn’t include. These include the standard Part B premium of $164.90 per month, copays/coinsurance for Part B services, and deductibles, such as the $1,600 Hospital (Part A) deductible and the $226 Medical (Part B) deductible.

Understanding General Costs

To better understand the financial aspects of Medigap Plan A, let’s break down the general costs:

Monthly Cost (Premium): $74 – $211*

Hospital (Part A) Deductible: $1,600

Medical (Part B) Deductible: $226

Part B Copays/Coinsurance: $0 (Generally your cost for approved Part B services)

*Note: The monthly cost doesn’t include the standard Part B premium of $164.90 each month.

Covered Services

Medigap Plan A covers various services under both Part A and Part B. Here’s a detailed breakdown:

Part A Services:

Hospital Stays:

Days 1-60: $1,600 (Part A deductible)

Days 61-90: $0

Days 91-150: $0 while using your 60 lifetime reserve days

Additional 365 days: $0 for Medicare-eligible services

After the additional 365 days: All costs

Skilled Nursing Facility (Medicare-covered stays):

Day 1-20: $0

Days 21-100: $200.00 per day

After 100 days: All costs

Blood (During a Hospital Stay):

First 3 pints: $0

After 3 pints: $0

Hospice Care: $0

Part A & B Services:

Home Health Care (Medicare-approved services): $0

Durable Medical Equipment (Covered by Medicare):

First: $226 (Part B deductible)

Then: $0

Part B Services:

Covered Part B Services:

First: $226 (Part B deductible)

Then: $0

Preventive Services: $0 (Generally for most preventive services Medicare covers)

Part B Excess Charges: All costs

Blood (Outside a Hospital Stay): First 3 pints: $0

After 3 pints: $226 (Part B deductible), then $0

Tests for Diagnostic Services: $0

*Note: Although the Part B deductible of $226 appears more than once, you only pay it one time each year.

Extra Benefits – Not Covered by Medicare

Medigap Plan A doesn’t cover certain extra benefits, such as foreign travel emergencies. However, it’s important to note that policies may include additional benefits not explicitly listed here. For a comprehensive understanding of your coverage, it’s advisable to contact the insurance company directly.

Choosing the right Medigap plan is a crucial decision for Medicare beneficiaries in Michigan. Medigap Plan A provides a solid foundation of coverage, but it’s essential to consider individual health needs and budget constraints. For personalized guidance and information on potential discounts, reaching out to the insurance company is key. By navigating the details of Medigap plans effectively, individuals can ensure comprehensive healthcare coverage tailored to their specific requirements.

There are 62 Medigap policies offered in Michigan

AARP – UnitedHealthcare Insurance Company

When it comes to securing comprehensive healthcare coverage, particularly for seniors, understanding the available options is crucial. Medigap policies play a significant role in filling the gaps left by original Medicare, offering a range of plans to meet diverse needs. In your state, there are 62 Medigap policies to choose from, each with its unique features and costs. In this article, we’ll delve into one such option – the AARP – UnitedHealthcare Insurance Company’s Standard plan.

A Closer Look at AARP – UnitedHealthcare Insurance Company (Standard)

Sorting through the multitude of Medigap plans can be overwhelming, but sorting them by monthly premium from low to high can help you find an option that fits your budget. The AARP – UnitedHealthcare Insurance Company (Standard) is one such plan with a monthly premium of $74. However, it’s essential to note that costs are estimates and may change. For a precise quote, it’s recommended to contact the company directly.

Understanding the Costs

The $74 monthly premium is a competitive rate, making the AARP – UnitedHealthcare Insurance Company (Standard) an attractive option for many seniors. It’s important to be aware that this cost doesn’t include the Standard Part B premium, which is $164.90. Therefore, when considering this Medigap policy, it’s crucial to factor in both premiums to get a comprehensive understanding of the financial commitment.

Household Discounts

One common concern among individuals seeking Medigap coverage is whether they can avail of a household discount on the monthly premium. Unfortunately, the available information doesn’t explicitly mention the availability of household discounts for this specific plan. To get accurate details about potential discounts, it’s advisable to reach out to the AARP – UnitedHealthcare Insurance Company directly.

Contacting AARP – UnitedHealthcare Insurance Company

For those interested in exploring the AARP – UnitedHealthcare Insurance Company (Standard) further or obtaining an official quote, it’s recommended to contact the company directly. The company’s contact details are as follows:

Address: PO BOX 30607, Salt Lake City, UT 84130-0607

Phone Number: 888-378-0849

Community Pricing

One notable feature of the AARP – UnitedHealthcare Insurance Company (Standard) plan is its community pricing structure. This means that premiums remain the same regardless of age, offering consistency and predictability for policyholders. However, it’s important to be aware that premiums may still increase over time due to factors such as inflation and other considerations.

Michigan Farm Bureau Health Plans:

When it comes to health insurance, finding a plan that meets your needs and fits your budget is crucial. One option worth exploring is the Michigan Farm Bureau Health Plans. In this article, we’ll delve into the monthly costs associated with these plans, explore potential household discounts, highlight excluded expenses, and provide essential contact information for obtaining accurate quotes.

Monthly Cost Breakdown

According to current estimates, the Michigan Farm Bureau Health Plans come with a monthly cost of $84. It’s important to note that these figures are subject to change, and for an official quote, individuals are encouraged to reach out to the company directly.

Household Discounts

Many individuals seek health insurance coverage for their entire household. If you’re wondering whether you can obtain a household discount on your monthly premium with Michigan Farm Bureau Health Plans, it’s crucial to contact the company directly for personalized information. Household discounts can significantly impact the overall affordability of health insurance, making it an essential aspect to explore.

Exclusions and Additional Costs

While the monthly cost is a significant factor, it’s equally important to be aware of what is not included in the estimated $84 premium. The Michigan Farm Bureau Health Plans do not cover the $164.90 Standard Part B premium. Understanding these exclusions helps individuals make informed decisions about their overall healthcare costs.

Contact Information

For those interested in obtaining a more accurate price for Michigan Farm Bureau Health Plans or have specific questions about household discounts, it’s recommended to reach out to the company directly. The contact information for Michigan Farm Bureau Health Plans is as follows:

Address: 323 E James M Campbell Blvd, Columbia, TN 38401

Phone number: 888-708-0123

Attained Age Pricing

One unique aspect of Michigan Farm Bureau Health Plans is the use of attained age pricing. Premiums are initially lower for younger buyers but gradually increase as individuals age, potentially becoming the most expensive option over time. This pricing structure underscores the importance of securing coverage early on to lock in lower rates.

Conclusion

Choosing the right health insurance plan involves careful consideration of monthly costs, potential discounts, exclusions, and overall pricing structures. Michigan Farm Bureau Health Plans offer a competitive option, but it’s crucial to reach out to the company directly for the most accurate and up-to-date information. By understanding the ins and outs of the monthly costs and associated details, individuals can make informed decisions about their healthcare coverage, ensuring both financial stability and comprehensive care for themselves and their households.

There are 60 more plans;

Allstate Health Solutions (Wearable)

Wellcare (Centene) (PDP Preferred)

Federal Life Insurance Company

Priority Health Insurance Company (Preferred)

Royal Arcanum

Philadelphia American Life Insurance Company

Wellcare (Centene)

Allstate Health Solutions

Woodmen Of The World Life Insurance Society

Priority Health Insurance Company (Tier 1)

Ace Property and Casualty Insurance Company

American Home Life Insurance Company

SBLI USA Life Insurance Company, Inc (Prosperity)

Medico Insurance Company (Preferred)

Blue Cross Blue Shield of Michigan (Conversion)

Blue Cross Blue Shield of Michigan (Guaranteed Issue)

Blue Cross Blue Shield of Michigan (Non-Guaranteed Issue)

American Benefit Life Insurance Company

Humana Achieve (Comp Benefits Insurance Company)

Humana (Humana Insurance Company)

Manhattan Life Assurance Company

Washington National Insurance Company

AFLAC

Paramount Insurance Company

State Farm Mutual Automobile Insurance Company

Transamerica Life Insurance Company (Direct)

United States Fire Insurance Company

Continental Life Insurance Company of Brentwood, Tennessee (Aetna)

Mutual of Omaha (Omaha Supplemental Insurance Company)

McLaren Health Plan Inc (Guaranteed Issue)

McLaren Health Plan Inc (Tier 1)

Medico Insurance Company (Standard I)

Elips Life Insurance Company

Capitol Life Insurance Company

Nassau Life Insurance Company

United American Insurance Company

Globe Life and Accident Insurance Company (Direct to Consumer)

MedMutual Protect

Cigna National Health Insurance Company

McLaren Health Plan Inc (Tier 2)

Wisconsin Physicians Service Insurance Corporation

Medico Insurance Company (Standard II)

Washington National Insurance Company (Substandard)

Bankers Fidelity Assurance Company (Preferred)

USAA Life Insurance Company

Health Alliance Plan of Michigan (Preferred)

Physicians Life Insurance Company

Assured Life Association

Priority Health Insurance Company (Tier 2)

McLaren Health Plan Inc (Tier 3)

Bankers Fidelity Assurance Company (Standard)

Guarantee Trust Life Insurance Company

Pekin Life Insurance Company

Health Alliance Plan of Michigan (Standard)

AARP – UnitedHealthcare Insurance Company (Level 2)

GPM Health and Life Insurance Company

Cigna National Health Insurance Company (Standard II)

Everence Association Inc.

Humana Insurance Company (Paper Apps Only)

SilverScript Insurance Company